I bet you know by now that I am always fighting my finances. We have curbed our unnecessary spending, without making it feel like we are doing without. With that said, I understand your unnecessary and my unnecessary might be worlds apart. We aren’t living a minimal lifestyle, but we are not living a gluttonous lifestyle either. I call it a win.

You know what I have been neglecting? My personal IRA. I’ve never worked for a company that helps set one up. I’ve never have a matching 401K, or a 401K at all. I have multiple savings accounts, but they do their job – save and save and save for an emergency and deplete the savings and start all over.

I didn’t know there was another way.

So a couple of years ago I opened an IRA with $100. The bank matched my $100 with $100 of their own. So \(^▽^)/! I made 100% on my IRA overnight. And promptly forgot about it.

I had good intentions. I was going to stuff $20 a week in that baby. Maybe more. Every skipped StarBucks was an opportunity for another five bucks in there.

You know what they say about good intentions.

Every skipped StarBucks meant five more bucks to spend on my kids and my IRA has collected roughly thirty-five cents a month for the last twenty-four months.

Hey man, that’s ten whole dollars for free! Or something.

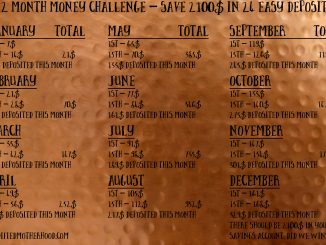

So yesterday I deposited $94, one dollar for each day of 2018 so far. I set up an auto transfer for another $24 at the end of the month (each remaining day in April). I scheduled a $31 transfer for the last day of each month through the end of this year. I set it up like a bill. I added it to my expenses spreadsheet. I’m not calling it savings. I’m calling it a bill. You see, I pay my bills on time every month. I don’t always save on time. So it’s a bill. If calling it a bill (payable… to me?) is what it takes to feed that little sad baby IRA, so be it.

Yes, the bulk of my “liquidity” is in the savings account. For that emergency. For that week my check is a little short. For that thing one of the kids needs yesterday. As it should be. Could I lock up this years IRA money all at once? This month, sure could. But that means just that much less in the emergency funds. And I’ve leaned to respect that money you can access now is more valuable than money you’ve locked up until you are in your sixties.

Be the first to comment