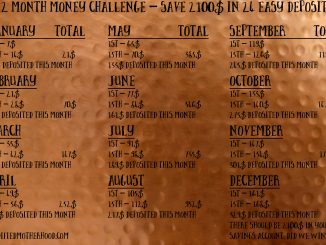

I have a plan. I have a goal. I have a terrifying spreadsheet of all of our monthly expenses, all of our debt, and all my expected future expenses (like things the children need) and a way to (almost) realistically pay them off/save for them in the next 36 months. OK, realistically? 48 – 60 months, and that’s so we can still, you know, eat and pay for things like car insurance and those irritating things the kids needs, like new clothes and school expenses.

I have a plan. I have a goal. I have a terrifying spreadsheet of all of our monthly expenses, all of our debt, and all my expected future expenses (like things the children need) and a way to (almost) realistically pay them off/save for them in the next 36 months. OK, realistically? 48 – 60 months, and that’s so we can still, you know, eat and pay for things like car insurance and those irritating things the kids needs, like new clothes and school expenses.

Five years sounds like such a long time. But really, it’s nothing. In five years two of my kids should be in college. In five years my baby will be in tenth grade. In five years I’ll be five years closer to my goals. Right now our living arrangements are stable. Right now our fridge is always well-stocked. We live pretty well. Too well. Too many impulse buys, not nearly enough “do we really need it?” was going on. Which is what got us into trouble!

Haven’t I told you everything comes back around to my need to downsize and go tiny? Instead of tunnel-vision, I have tiny-vision. Since that has become my new goal, our “useless crap” spending has nearly become zero. My savings isn’t growing (yet), and these last few months have been pretty rough, but once things pick back up, our debt (that was run up in part because of slim months) should start shrinking, our savings should start (re)growing, and we should be well on our way.

I find I often look so much at the big picture that the details get in my way. This year I’m focusing on the details so my big picture comes together a little faster.

I don’t have a spreadsheet for you to download. Yet.

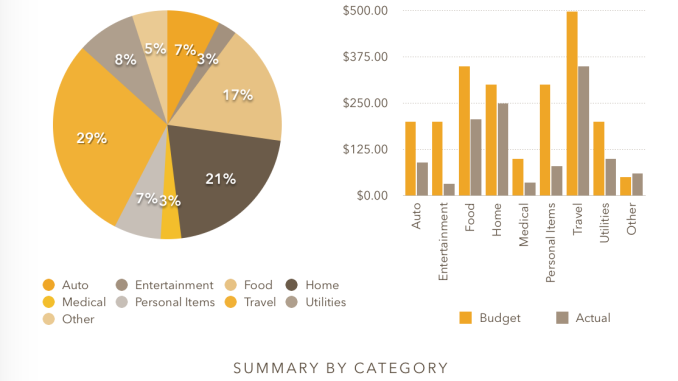

But I might later on. The idea of properly annotating mine for use frightens me. I mean, my spreadsheet is pretty basic as far as spreadsheets go, but it’s extensive, and has multiple pages, and I’m feeling rather lazy about annotating a blank copy. Column A is just a list of income and expenditures (including all bills). Column B has its due date (if applicable). Column C has the date paid. Column D is the total awed. Columns E & F are my two checking accounts. I use those to note how much I paid/spent and which account it came out of. Column G is the total left after the payment. Way down at the bottom I have individual totals for Columns D, E, F, and G. Everything is color coded (monthly bill, credit card, car loan, medical, deposit).

The second sheet of the file ties into the first, and grabs all those totals and calculates my rolling pay off plan. Basically, as I update that during the month, the payoff plan auto-updates as well. Anything that is zero balanced turns red so I get a nice visual indication of how it’s going.

Like I said, I don’t have a blank, but there are a million free spreadsheet downloads out there if you aren’t up to writing your own. Etsy even has a few for sale. I know Numbers and Excel come with a few basic monthly budget spreadsheets (I used one as my featured image).

Funny thing is, I hate math. I love a good math joke. I find myself ass-deep in math often. But math is the bane of my existence. It amuses me how much I love a good spreadsheet vs. how much I really, really dislike math. I think it’s the organization that gets me.

Be the first to comment