I don’t know about you, but even my blog here indicates that 2017 was a pretty shit year. Three whole posts. Are you even out there? Am I talking to crickets?

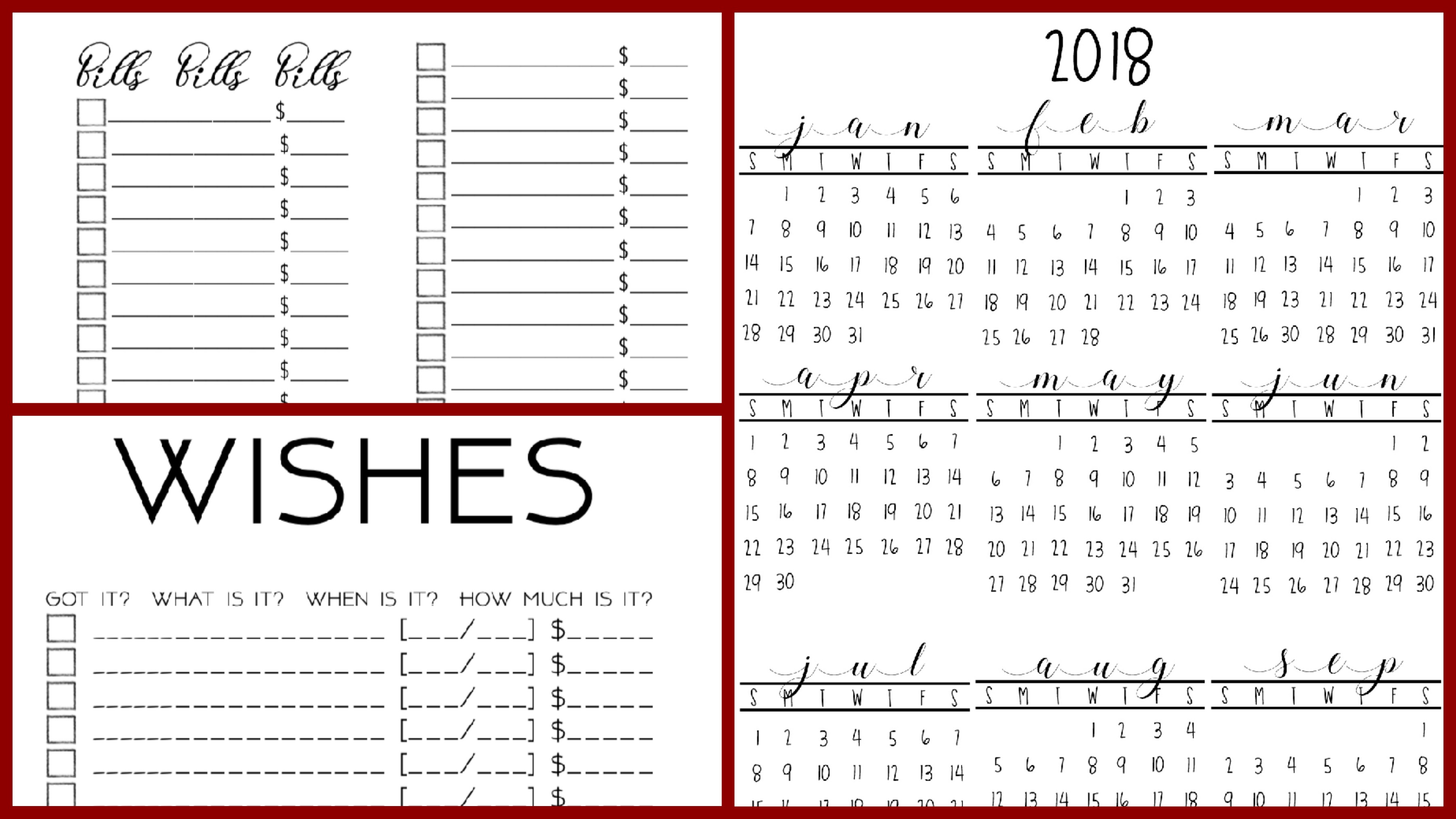

It’s February. I’ve been sitting on half a dozen half-finished articles. None of them are ready to sharing. Some of them are holiday-specific, and probably won’t ever be shared. I finally put together a 2018 year-at-a-glance printable. So at least there is that.

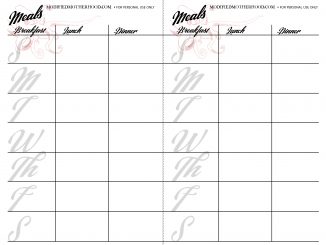

This years bullet journal is actually a Hustle Stone Planner. Yes, the one I was super excited to get last year. It arrived a few months too late for me to be happy using it, so I saved it for this year. There is totally a method to my madness. I haven’t decided if I love it or not, or if it is way too structured for my needs. I’ve already started whiting out the time micro-management in order to just use it for my handy dandy bujo lists. I’ve stopped using the habit starter for starting and have started using it for stopping. Did you follow that travesty of word vomit? I guess if you want to spin it positive, I am starting to stop bad habits? It’s definitely got a learning curve after a couple of years of a free-form moleskin journal cum planner.

Last year, I purchased these shipping labels. The package was so big, I of course have used them for all my journal printable needs and still have most of the package left. \(^▽^)/Due to the structure of the Hustle Planner, there is no space for sticker printables anyway, so it gets plain paper inserts. (It also came with a year-at-a-glace page for 2017 and 2018, so why did I make a new printable version? For my side planners of course!)

What about bills?

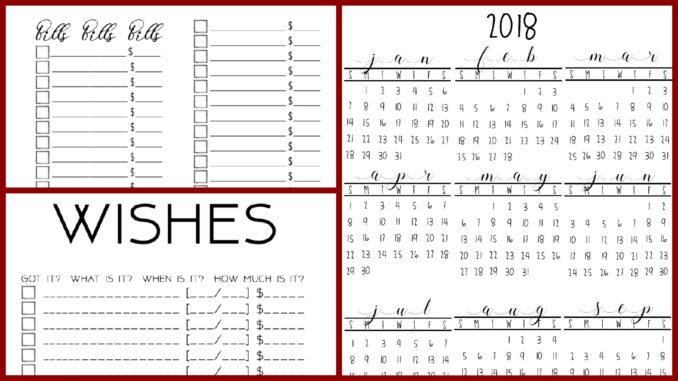

I print out a monthly bill list. I check it off once it’s been paid, and note how much was paid. I am working on that Dave Ramsey snowball method. Again. So far I am down two small debts, and rolled those payments into a high interest debt, that will roll into a smaller debt, and back into a high interest… yes I am bouncing back and forth. I want to save by knocking out those high interest debts, BUT I also want to pay off those smaller debts quicker. So for us, moving back and forth is working so far.

I also keep a list of wishes. Why? Because all those things I have to have now I don’t really need ever. What winds up on this list? Everything from bluetooth keyboards for my iPad (I have a spare keyboard, but it’s not in a case *whine whine whine*) to more shirts to stupid impulse buys. I try to tell myself I will put the money I would have spent on those things I don’t need into savings, but I never do. Don’t get me wrong. I still spend money I have no business spending on things I don’t need. I am a work in progress. Aren’t we all?

Be the first to comment